The Opportunity:

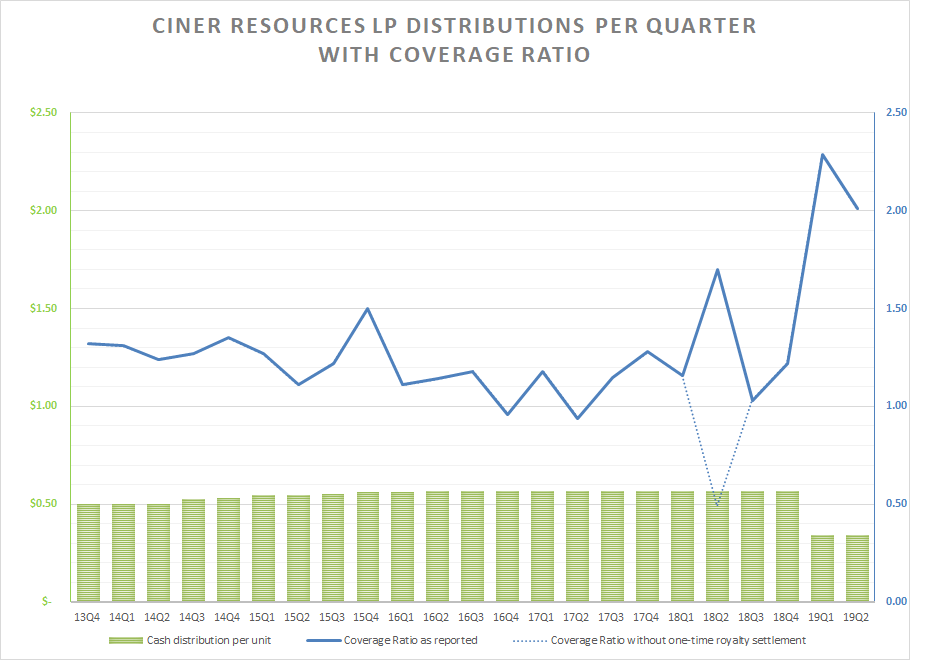

Ciner Resources LP (NYSE: CINR) is a Master Limited Partnership (MLP) that owns 51% of Ciner Wyoming LLC, one of the lowest cost producers of soda ash in the world. In the spring of 2019, Ciner LP shares, or units in MLP terminology, were regularly yielding 9% with a 1.1x coverage ratio. Management, in order to fund an expansion project to grow production by one third, cut the $.57 quarterly distribution by 40% to $.34 in May 2019. Four months later, the unit price is down nearly as much, but the yield is back to 8.6% with an improved 2.0x coverage ratio and a roadmap to increased distributions. Management projects the cut to remain in place for 9-11 more quarters after which the distributions will be increased to target a 1.2-1.3 coverage ratio.

Investors who buy now will collect an 8.6% yield for the next two and a half years until the distribution is reset to a 1.3 coverage ratio, for an approximately $.45 to $.50/quarter distribution. In years 3 and 4, the distribution will climb to roughly $.60/quarter by the end of year 5 as production ramps. A $2.40 distribution should support a $28/unit price at a well-covered 8.5% yield. At today’s $15.75 price, that’s a 20% IRR for 5 years.

Why does this opportunity exist?

MLP’s are mostly owned directly by individuals, or indirectly though high-income funds, that price stocks excessively on yield. These same individuals who underestimated the risk of a distribution cut when the unit price was higher are now underestimating the value of the MLP after it redirected 40% of the distribution into new capital investments. In ten quarters, the distribution will be raised, but today’s sellers won’t be around to benefit.

Additionally, CINR’s thin daily trading volume of 15,000-25,000 units leads to overreactions exposing market inefficiencies. With a public float of only 22%, or 5.5 million units, the daily volume is unlikely to increase as the remaining 14.2 million LP units are owned by the general partner (GP) and do not trade.

The volume is also low because many investors simply do not want an investment that produces a K-1 in their holdings regardless of the opportunity. As one manager told me when I pitched him the idea, “If I put a K-1 in my clients’ accounts, they’ll kill me come tax time.” This is unfortunate, because Ciner operates in Wyoming, a state with no income tax. With no state filing required, its K-1 paperwork is greatly simplified, but many people, once burned by a complicated MLP K-1 never buy a simple one either.

Ciner makes soda ash by mining the sodium rich mineral, trona.

Ciner Wyoming owns and operates a large trona mine in southwest Wyoming. The mine began production in 1964 and as of 2019 still holds 59 years of reserves. From the trona deposits it mines, the company produces soda ash which in turn serves as a building block for making flat glass, container glass, industrial chemicals, detergents, paper, and other consumer and industrial products. As countries develop, their citizens inevitably use more soda ash. Consumption in the U.S. is 34 pounds per capita, while global consumption ex-US is 14 pounds per capita.

Global production of soda ash is approximately 57 million tons. Roughly 17 million of these tons come from trona-based production of which Ciner Wyoming’s share is 2.6 million. The remaining 40 million tons are produced synthetically from raw materials (salt, limestone, ammonia) using the Solvay process as well as Hou’s process in China. Synthetic processing is inherently more expensive than mining because it requires more energy and it creates unwanted byproducts. Synthetic production is dominant because there is insufficient trona production to meet global demand and because plants, unlike mines, can be built close to their end-users to reduce freight costs. There are no synthetic soda ash plants in the United States.

While U.S. demand trends are flat, multiple sources show global trends growing a 2% to 3% annual growth rate out to 2025 for an additional 1 to 1.6 million short tons per year. While some demand growth will be met by adding incremental trona mining, higher-cost synthetic plants will still need to supply roughly 70% of global soda ash demand for years to come as the best located and most-economic trona deposits are already engaged in soda ash production.

Green River Basin Trona deposits

The soda ash reserves in the Green River Basin of Wyoming compose 80-90% of the world’s approximately 25 billion tons of known reserves (USGS 2018). The deposits in Wyoming are the legacy of a fifty-million-year-old, 15,000 square mile, freshwater lake. This body of water, about 75% the size of today’s Lake Michigan, evaporated quickly and repeatedly many times, leaving the sediment from nearby sodium-rich runoff to collect in layers at the lake’s bottom during each evaporation cycle. Today, 85% of U.S. soda ash production is in Wyoming with the remainder coming from solution mining in Searles Valley, California.

Ciner Wyoming mines 4 million tons of trona annually to produce 2.6 million tons of soda ash. The difference is a function of the ore to ash ratio and the purity of the ore. Ciner Wyoming’s ratio of 1.5:10 and 85.8% respectively is indicative of the high quality of the Green River Basin deposits. The deposits are also only 800 and 1100 feet below the surface, or only half the depth of competitors’ mines in the region, and these shallower beds also have less halite impurities as well.

These geologic “gifts” translate into improved economics. From the 2018 10-K,” We have a competitive advantage because we can mine the trona and roof bolt simultaneously on our continuous miner equipment. In addition, the trona in our mining beds has a higher concentration of soda ash as compared to the trona mined at other locations in the Green River Basin, which is typically imbedded or mixed with greater amounts of halite and other impurities. Our trona ore is generally composed of approximately 80% to 89% pure trona.”

The shallower depth and higher quality of the ore, as well as deca rehydration (discussed later), are the three primary factors that allow Ciner Resources LP to operate with fewer employees than its competitors according to the 2018 Annual Report of the State Inspector of Mines of Wyoming.

2018 Wyoming Trona Production & Employment

| Operator | Mine | Employees | Production (Tons) |

| Ciner Wyoming, LLC | Big Island Mine | 436 | 4,002,657 |

| Genesis Alkali, LLC | Genesis Alkali | 824 | 4,224,660 |

| Solvay Chemicals Inc. | Solvay Chemicals Inc. | 438 | 4,550,279 |

| Tata Chemicals (Soda Ash) Partners | Tata Chemicals Mine | 527 | 4,622,233 |

| TOTAL | 2,225 | 17,399,829 |

Deca Processing is a competitive advantage

Ciner Resources surface land availability and manufacturing process allows for a lower cost method of extracting soda ash from its liquid waste streams than is available to its nearby competitors. This process is called deca rehydration.

From the 2018 10K, “The evaporation stage of our trona ore processing produces a precipitate and natural by-product called deca. “Deca”, short for sodium carbonate decahydrate, is one-part soda ash and ten parts water. Solar evaporation causes deca to crystallize and precipitate to the bottom of the four main surface ponds at our Green River Basin facility. In 2009, we implemented a process called deca rehydration, which enables us to recover soda ash from the deca-rich purged liquor as a by-product of our refining process. We capture the soda ash contained in deca by allowing the deca crystals to evaporate in the sun and separating the dehydrated crystals from the soda ash. We then blend the separated deca crystals with partially processed trona ore at the dissolving stage of our production process. This process enables us to reduce our waste storage needs and convert what is typically a waste product into a usable raw material. “

But the deca rehydration process is also a driver for the new capital work, as the 2018 10K states, “Our deca stockpiles will substantially depleted by 2023 and our production rates will decline approximately 200,000 short tons per year if we do not make further investments.” [This would be a 7.5% decline on 2,600,000 short tons/year].

This bombshell was mentioned for the first time in the 2018 10K issued in March 2019. Either management intentionally withheld this information previously, was ignorant of their overproduction, or in the best case, they thought the overharvesting would be at a lower, non-material rate of decline. Whichever the cause, I like to admit my mistakes early before they grow larger. In a perfect world my CEO’s would do the same, unlike how this unfolded.

Growing production to 3.5 million short tons

The new capital project aims to not only make up the deca shortfall but increase production to 3.5 million short tons annually as well. Previous debottlenecking investments since Ciner took over from OCI, aimed to raise production to 3 million short tons by making incremental upgrades to existing facilities, but these efforts only succeeded in maintaining production. This project will instead add a new processing line on the surface and below ground to raise production by a third.

The expansion project cost is estimated up to $400 million and includes $50 million for an electricity/steam cogeneration facility initiated, and partially funded, in 2018. This new source of electricity and heat will provide roughly one-third of the site’s electricity needs by year end 2019. Once fully operational, the savings in electricity spend will increase EBITDA by $7-10 million annually beginning 2020. The corporate parent, Ciner Group, is experienced in this space by building and operating the two largest cogeneration plants in Turkey.

To fund the capital project, half the cost of the expansion will be paid by the distribution cut and half will come from debt. Current debt financing uses a variable rate but was 4.1% after hedges in 2018. The cogeneration savings previously mentioned could cover much of the interest expense of the additional 200 million in debt until the production increase is realized.

Green River Basin shipping costs

Ciner Wyoming ships over 93% of its product by rail, either to domestic customers in North America or for international customers through ports in Portland, Oregon and Port Arthur, Texas. Prices for domestic sales include shipping to the customer but for international sales are only to the port f.o.b. Ciner Wyoming’s export markets are heavily influenced by shipping cost as soda ash is a bulky commodity. In 2017 and 2018, freight charges were 29% of sales.

Rise of Turkey in the Soda Ash market

The United States dominates global soda ash reserves with 23 billion short tons of known reserves. Second place belongs to Turkey with 1-2 billion and Botswana at third with 400 million. While Turkey’s reserves are much smaller than those in the U.S., they are still meaningful and well-located for serving the European market from the Turkish port of Derince only 150 miles away from the mines. In 2018, soda ash from Turkey was shipped to the east coast of the United States for less than the cost of shipping soda ash by rail from Wyoming.

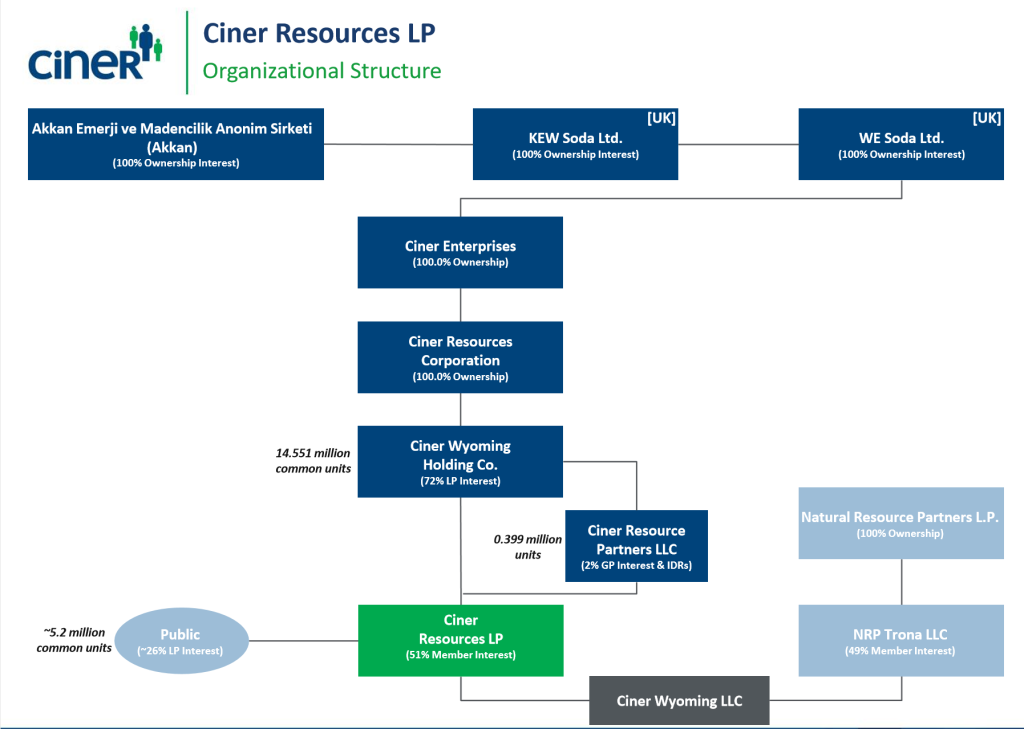

Ciner group, a large Turkish conglomerate with interests in energy, mining, chemicals, and shipping, also owns a string of holding companies that ultimately owns Ciner Resources Partners LLC, the general partner (GP) of Ciner Resources LP, in the United States. Ciner Group also owns the Eti Soda and the Kazan Soda mines in Turkey.

The new Kazan mine brought an additional two million annual tons of soda ash online using trona solution mining beginning in 2018. The market absorbed this increase without a noticeable impact on pricing with most of its exports going to nearby European markets.

Ciner Resources LP Ownership

Ciner Group bought 72% of Ciner Resources LP and 100% of its GP in November 2015 from OCI Resources for $450 million. The purchase of the 2.6 million short ton production in Wyoming, combined with its 4-million tons of production in Turkey makes Ciner Group the largest producer of soda ash worldwide.

Natural Resource Partners LP (NRP) stake

NRP bought a 49% stake in OCI Wyoming, Ciner Wyoming’s predecessor, from Anadarko in 2013 for $293 million. Last year, NRP received $46.5 million in cash distributions from Ciner Wyoming and $49 million in 2017. NRP owns a non-controlling 49% stake in Ciner Wyoming LLC and gets to appoint three of the seven members to the board of directors. Ciner Resources has first right of refusal on any sale of the NRP’s stake and vice versa.

NRP also agreed in 2013 to pay up to $50 million in earn-outs to Anadarko if OCI Wyoming reached specified targets for the following three years. While NRP paid Anadarko $11.5 million in earn-outs, but Anadarko is suing NRP for an additional 40 million in an accounting dispute over the remainder. The outcome of this lawsuit is between NRP and Anadarko and will not affect Ciner Wyoming.

Ciner Group Growth Strategy

Ciner Group is “Dünyanin En Büyük Üreticisi”, the world’s largest manufacturer of soda ash.

Light blue columns are mined soda, brown columns are synthetic production. Source: Cinergroup.com.tr

Ciner Group growth and sales strategy

Given Ciner Group’s low trona-based production cost in Turkey and the low cost of ocean shipping, its product is almost always cheaper than using soda ash made from synthetic production to most ports in EMEA and the Americas. Likewise, their U.S. company, Ciner Resources possesses many of the same advantages when shipping its trona-based soda ash production to North America and the South East Asian markets.

Scuttlebutt in the press is that Ciner Group may open additional Turkish trona capacity in the future, but at a minimum it would take several years to bring a greenfield operation online. Even then, with global markets growing demand by 1 million short tons per year, additional Turkish capacity or capacity upgrades in the Green River Basin from Ciner Resources and its competitor should not have trouble finding customers.

In June 2019, Şişecam Group, a large glass manufacture and synthetic soda ash producer, signed an equal production partnership contract with Ciner Group for the natural soda production in the US. This new project will have an annual natural soda production of 2.5 million tons as well as 200,000 tons of sodium bicarbonate. It is to be financed with a long-term project loan for 80% with the balance covered by equity capital invested equally. Unlike Ciner Resource’s mine, the new operation would use the solution mining technique Ciner uses at its Kazan operation to extract the trona by dissolving it underground and removing the soda ash above ground. Advances in horizontal drilling have increased the efficiency of this technology from earlier solution mining processes.

My guess is the greenfield investment is related to Ciner Group’s, new “Imperial Trona” subsidiary which is in the permitting process to mine lands with sodium assets about 40 miles south of Ciner Wyoming’s current facility. The application is currently under review by the Bureau of Land Management. So far, all the public comments for the application and its potential for new mining jobs are favorable.

Exiting ANSAC

Currently, international sales, marketing, and logistics from the Green River Basin producers, Genesis Alkali, Tata Chemicals and Ciner Resources Corporation, are managed by the American Natural Soda Ash Corporation. ANSAC is a cooperative created and run for the benefit of the participant companies. Each participant sells its products for the international markets to ANSAC which pools the product and returns the sales proceeds less expenses pro-rata. ANSAC’s primarily serves Latin America and Asia. Europe considers ANSAC a cartel more than a cooperative and correspondingly prohibits it from selling into the European Union.

In November 2018, Ciner Resources gave notice that it will exit the consortium on Dec 31, 2021. Ciner Resources plans to use Ciner Groups sales, marketing and logistics after this date. The combination of Ciner Resources and Ciner Group volumes will make Ciner the largest exporter of soda ash globally. Ciner Resources expects this leverage will eventually lower its cost position and improve its ability to optimize market share both domestically and internationally. In some cases, such as Ciner Group developing exclusive modern port facilities in Port Longview, WA and in North Carolina for Ciner affiliates to utilize, I tend to agree.

However, there will always be an inherent conflict of interest when Ciner group selects customer shipments for its 74%-100% owned ventures vs its 51% Ciner Resources holding. But eventually, Ciner Resources LP will hit the upper end of its incentive distribution rights threshold and the math could change to favoring Ciner Wyoming sales in five years.

CEO turnover

After a twenty-year career, the last ten as CEO, with Ciner Resources and its predecessor, OCI Chemical, Kirk Milling, resigned suddenly on June 17, 2019 and was replaced by Oğuz Erka, on one day’s notice. Mr. Milling also received a one-million-dollar separation agreement which included a non-compete agreement. He wrote a positive exit letter praising the current plan and Mr. Erka which is not surprising considering his large severance.

There is little public information about Mr. Erka. He was the Director of International Operations & Coordination at parent company, Ciner Enterprises, prior to taking his new assignment. He is 41 and holds a bachelor’s degree in marketing and international business from Northwest Missouri State University. Ciner Group also sponsors the Kasimpasa football team in Turkey where Mr. Erkan serves as a director. Let’s hope this is more of a networking opportunity and chance to take pictures with footballers than a business distraction. He is also president of Imperial Trona, a new Ciner Enterprises entity, that in 2018 applied for a sodium mining lease in southwest Wyoming and is another indication of Ciner Group’s soda ash growth through trona mining strategy which he helped develop.

Operationally, the Deca shortfall surprise this year and the failure of previous efforts to increase production through debottlenecking the facility the past five years did not bode well for Mr. Milling’s tenure. Mostly likely though, it was only a matter of time before a Ciner Group executive took over the Ciner Resources CEO position.

Incentive Distribution Rights Agreement

The general partnership agreement provides for Ciner Resources LP to pay an Incentive Distribution Rights (IDR) to the General Partner once the quarterly distribution exceeds $.50/quarter. This level is substantially above the current $.34/quarter rate. While the rate starts low at 2%, it then jumps quickly in three steps to 50% at $.75/quarter.

| Total Quarterly Distribution per Unit Target Amount | Marginal Percentage Interest in Distributions | |

| Unitholders | General Partner | |

| above $0.5000 up to $0.5750 | 98% | 2% |

| above $0.5750 up to $0.6250 | 85% | 15% |

| above $0.6250 up to $0.7500 | 75% | 25% |

| above $0.7500 | 50.0 | 50% |

While I strongly dislike paying IDR’s, they do incentivize a GP to grow the distributions. My investment horizon for CINR ends with a nice capital gain well before the IDR hits 50%.

Risks – Global Recession

Soda ash prices would decline in a global recession as glass demand in construction and autos would certainly glass drop as well. A 20% drop in the sales price revenue at current production rates and costs would take Ciner Resources’ operating income to zero. But that is overly simplistic, as Ciner uses annual contracted prices which are less variable and production inputs such as shipping, and energy costs would decrease in a recession. Most importantly, the impact of steep decline in prices would be more severe on higher cost synthetic producers who eventually cut production. Ciner Resources’ predecessor stayed profitable and remained at full production throughout 2008-2009.

Risk – Project overruns

Many large industrial and mining projects run over budget and time estimates. I would expect Ciner to encounter some unforeseen challenges as well. A strong mitigating factor in Ciner Resources’ favor is that the Green River Basin is an extremely well defined, low risk area from which to mine trona and the company is well experienced with operating the trona to soda ash processing operations. Furthermore, Ciner group is experienced having recently built out the Kazan mine and processing facility from 2015-18. The Kazan plant was built in about three years or roughly six months over the original projection.

Risk – Lack of Governance

When investing in MLPs, lack of governance is just the reality of a LP/GP structure. One must decide before investing in the LP, if the General Partner’s owners have enough skin in the game at the LP level to profit from its success as well. In Ciner Resource LP’s case, Ciner Group’s 72% ownership of the LP and the opportunity to collect IDR’s by growing the distribution are enough for me, but I’ve listed some of the governance risks below for those don’t regularly invest in MLPs.

- The GP is difficult to replace. The GP cannot be replaced with less than a two-thirds majority of the LP’s, and Ciner own 72% of the LP units. Even with a two-thirds majority, removal is not immediate.

- Conflict of interest. From the 10-K, “Ciner Enterprises and other affiliates of our general partner are not restricted in their ability to compete with us.”

- Take-under risk. If the GP should own 80% of the LP’s units, it may buyout the remaining minority unit holders based on recent prices at the time it chooses to do so.

Risk – Single Facility risk

Ciner Wyoing operates out of a single facility and is subject to unexpected mine issues, natural disasters, and other rare, but non-zero events. Management does carry an unspecified amount of insurance on the business. Mine safety 2016 extended outage

Risk – ANSAC termination

Ciner Resources withdrawal from the ANSAC sales cooperative on December 31, 2021 will introduce a risk during the transition period from ANSAC to Ciner Group for international sales. I would expect that it is more likely that some sales get delayed or are offered at lower prices to win new business than that the transition occurs without any issues.

Ciner Resources is also likely to have less influence in ANSAC than previously now that it has given its termination notice.

Risk – Environmental

Self-bonding. Ciner Wyoming’s principal mine permit issued by the Wyoming Land Quality Division requires a “self-bond” for the estimated future cost to reclaim the area of our processing facility, surface pond complex and on-site sanitary landfill. As of December 31, 2018, the amount of the self-bond was $32.9 million but this estimate is subject to periodic re-evaluation by the Land Quality Division. The recent coal company bankruptcies in Wyoming have raised attention in the state legislature as to whether self-bonding is an appropriate mechanism for assuring remediation is completed at a mine’s termination. A state law change in the self-bonding policy to require third party bonding would increase costs.

Ciner Resources LP Capitalization, (millions except $ per unit data)

| Total LP + GP Units = | 20.1 |

| Market Price = | $15.75/unit |

| Market Cap = | 317 |

| Cash (6/30/19) | 9.4 |

| Long Term Debt (6/30/19) | 145.5 |

| Enterprise Value | 453 |

| EBITDA (TTM) | 132 |

Financials

| ($ in millions, except per unit data) | 2019

1st half | 2018 | 2017 | 2016 | 2015 | 2014 |

| Soda ash produced (thousand short tons) | 1353 | 2613 | 2667 | 2695 | 2663 | 2544 |

| Net sales | 260.2 | 486.7 | 497.3 | 475.2 | 486.4 | 465.0 |

| Cost of products sold including freight costs | 180.8 | 355.0 | 356.7 | 335.6 | 332.4 | 325.3 |

| Net income | 49.0 | 103.0 | 86.4 | 86.3 | 106.2 | 91.9 |

| Net income attributable to non-controlling interest | 25.4 | 53.1 | 44.8 | 44.9 | 54.7 | 47.4 |

| Net income attributable to Ciner Resources LP | 23.6 | 49.9 | 41.6 | 41.4 | 51.5 | 44.5 |

| Distributable cash flow | 29.5 | 58.4 | 52.0 | 50.4 | 56.8 | 53.5 |

| Cash distribution declared per unit | $0.68 | $2.27 | $2.27 | $2.27 | $2.19 | $2.06 |

| Distribution coverage ratio | 2.15 | 1.28 | 1.14 | 1.10 | 1.27 | 1.29 |

| Adjusted EBITDA | 66.0 | 136.5 | 120.1 | 116.5 | 133.9 | 120.5 |

The above financials include Ciner Wyoming receiving a one-time royalty settlement in June 2018 for $27.5 million. ($14 million net to Ciner Resources LP).

Margins

| 2019

1st half | 2018 | 2017 | 2016 | 2015 | 2014 | |

| Gross Margins | 69% | 73% | 72% | 71% | 68% | 70% |

| Net Margins | 19% | 21% | 17% | 18% | 22% | 20% |

| Sales price per ton ($/short ton) | 192 | 186 | 186 | 176 | 183 | 183 |

| Cost of product incl. freight ($/short ton) | 134 | 136 | 134 | 125 | 125 | 128 |

| Net income ($/short ton) | 36 | 39 | 32 | 32 | 40 | 36 |

| Adjusted EBITDA (millions) | 66 | 137 | 120 | 117 | 134 | 121 |

| Adjusted EBITDA ($/short ton) | 49 | 52 | 45 | 43 | 50 | 47 |